All Categories

Featured

Table of Contents

These functions can differ from company-to-company, so be certain to explore your annuity's survivor benefit attributes. There are numerous benefits. 1. A MYGA can suggest lower tax obligations than a CD. With a CD, the interest you gain is taxed when you make it, despite the fact that you do not obtain it up until the CD develops.

At the extremely least, you pay taxes later on, instead than sooner. Not only that, yet the worsening interest will be based on an amount that has actually not already been exhausted.

Your recipients can select either to receive the payout in a lump amount, or in a series of revenue payments. 3. Typically, when somebody passes away, even if he left a will, a court decides who obtains what from the estate as in some cases loved ones will argue concerning what the will ways.

It can be a long, complicated, and very expensive procedure. People go to terrific sizes to avoid it. With a multi-year set annuity, the proprietor has clearly marked a recipient, so no probate is called for. The cash goes straight to the recipient, no questions asked. sell annuity payment. If you add to an individual retirement account or a 401(k) plan, you receive tax deferral on the earnings, much like a MYGA.

Fixed Rate Annuity Rates

If you are younger, invest just the funds you will certainly not need until after age 59 1/2. These can be 401(k) rollovers or cash you hold in IRA accounts. Yet those items already supply tax obligation deferral. MYGAs are wonderful for individuals that desire to avoid the dangers of market variations, and desire a repaired return and tax deferral.

The insurer spends it, typically in high quality long-term bonds, to fund your future settlements under the annuity. Bear in mind, the insurance provider is depending not just on your private settlement to fund your annuity.

These compensations are constructed into the purchase rate, so there are no concealed charges in the MYGA contract. Actually, postponed annuities do not charge fees of any type of kind, or sales charges either. Certain. In the recent atmosphere of low rate of interest, some MYGA investors develop "ladders." That means acquiring numerous annuities with staggered terms.

Annuity Basis Definition

If you opened MYGAs of 3-, 4-, 5- and 6-year terms, you would certainly have an account maturing each year after 3 years (annuity liquidation). At the end of the term, your cash can be withdrawn or placed into a new annuity-- with luck, at a greater rate. You can likewise use MYGAs in ladders with fixed-indexed annuities, a technique that looks for to make the most of return while likewise safeguarding principal

As you contrast and contrast pictures offered by different insurer, take right into factor to consider each of the locations detailed over when making your final choice. Comprehending contract terms in addition to each annuity's benefits and downsides will enable you to make the finest decision for your monetary scenario. Think thoroughly concerning the term.

Types Of Annuity Contracts

If passion rates have climbed, you might want to lock them in for a longer term. During this time, you can get all of your money back.

The company you acquire your multi-year assured annuity through accepts pay you a fixed rate of interest on your premium amount for your selected amount of time. You'll get rate of interest attributed on a regular basis, and at the end of the term, you either can renew your annuity at an updated rate, leave the cash at a dealt with account rate, choose a negotiation option, or withdraw your funds.

Fixed Interest Annuity Rates

Given that a MYGA supplies a fixed interest price that's ensured for the contract's term, it can offer you with a foreseeable return. With rates that are established by agreement for a specific number of years, MYGAs aren't subject to market changes like various other investments.

Annuities typically have charges for early withdrawal or abandonment, which can limit your capability to access your cash without charges. MYGAs may have reduced returns than stocks or mutual funds, which might have greater returns over the lengthy term. Annuities normally have abandonment fees and management costs.

MVA is an adjustmenteither positive or negativeto the accumulated value if you make a partial surrender above the cost-free quantity or totally surrender your contract throughout the surrender cost period. Due to the fact that MYGAs use a set rate of return, they may not maintain speed with inflation over time.

5 Year Period Certain Annuity

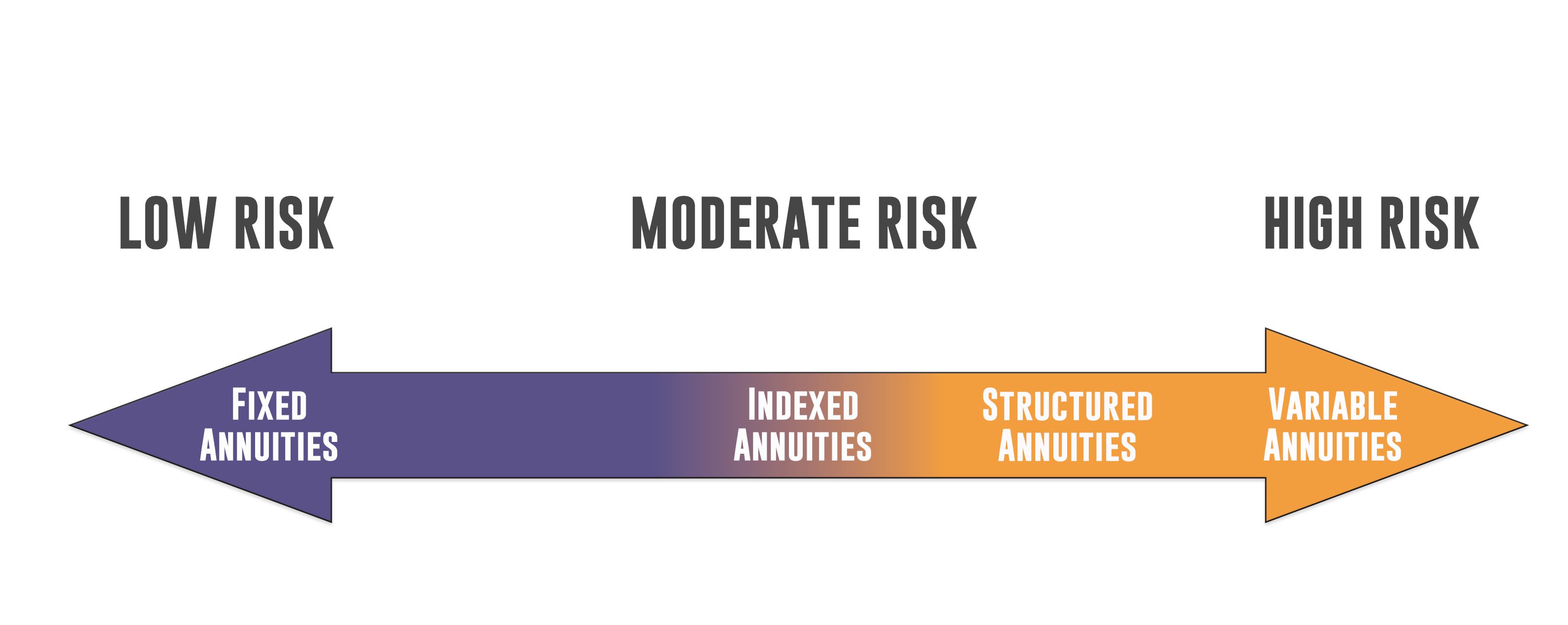

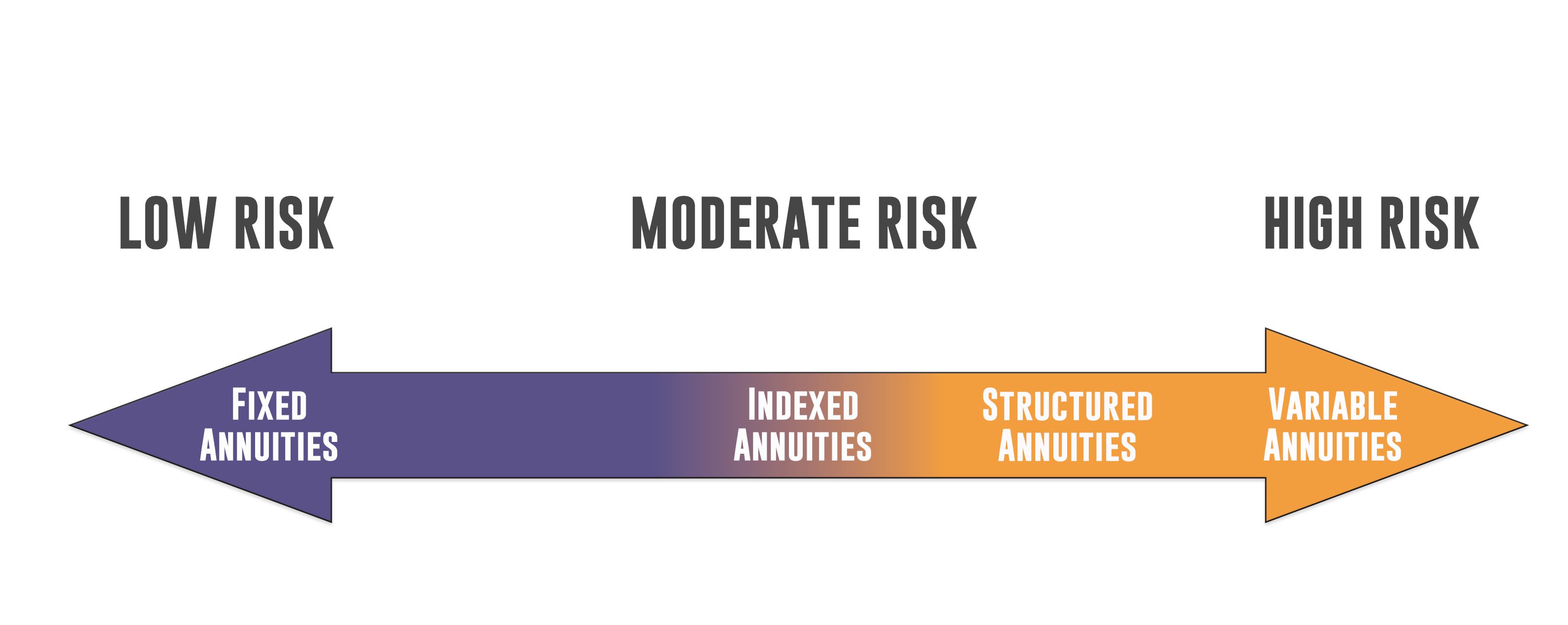

It is very important to vet the stamina and stability of the business you choose. Look at reports from A.M. Finest, Fitch, Moody's or Standard & Poor's. MYGA rates can transform usually based upon the economy, but they're usually greater than what you would make on a savings account. The 4 sorts of annuities: Which is right for you? Need a refresher on the 4 standard sorts of annuities? Discover extra just how annuities can ensure an earnings in retirement that you can't outlast.

If your MYGA has market worth adjustment provision and you make a withdrawal prior to the term is over, the company can readjust the MYGA's abandonment worth based on modifications in rates of interest - annuity report. If prices have actually raised because you purchased the annuity, your abandonment worth may lower to represent the higher passion rate atmosphere

Not all MYGAs have an MVA or an ROP. At the end of the MYGA duration you've chosen, you have three options: If having actually an ensured rate of interest price for a set number of years still lines up with your financial method, you merely can restore for an additional MYGA term, either the same or a various one (if available).

With some MYGAs, if you're uncertain what to do with the cash at the term's end, you do not have to do anything. The accumulated worth of your MYGA will certainly relocate into a dealt with account with a sustainable one-year rate of interest figured out by the firm - how much do annuities pay out. You can leave it there until you pick your next step

While both offer guaranteed prices of return, MYGAs usually use a greater interest rate than CDs. MYGAs grow tax obligation deferred while CDs are exhausted as revenue every year.

This decreases the potential for CDs to take advantage of long-lasting compound interest. Both MYGAs and CDs typically have very early withdrawal penalties that may influence short-term liquidity. With MYGAs, surrender fees may use, depending upon the kind of MYGA you choose. You may not only shed passion, however also principalthe cash you originally contributed to the MYGA.

401k Annuity Option

This implies you may lose interest yet not the major amount added to the CD.Their conventional nature frequently charms extra to individuals that are approaching or currently in retirement. They might not be best for everybody. A might be right for you if you wish to: Make use of a guaranteed rate and secure it in for a time period.

Advantage from tax-deferred earnings development. Have the alternative to choose a negotiation option for an assured stream of income that can last as long as you live. As with any type of kind of savings automobile, it is very important to very carefully examine the terms of the item and speak with to figure out if it's a wise option for achieving your specific demands and goals.

1All guarantees including the survivor benefit settlements depend on the insurance claims paying capability of the issuing business and do not relate to the investment efficiency of the underlying funds in the variable annuity. Assets in the hidden funds are subject to market threats and may fluctuate in value. Variable annuities and their underlying variable financial investment choices are sold by program only.

Annuities 101 How To Sell To Senior Citizens

Please review it prior to you spend or send out money. 3 Existing tax regulation is subject to analysis and legislative change.

Entities or persons distributing this info are not licensed to provide tax or lawful recommendations. People are urged to seek particular recommendations from their individual tax or lawful guidance. 4 , Exactly How Much Do Annuities Pay? 2023This material is planned for basic public usage. By giving this content, The Guardian Life Insurance Policy Company of America, The Guardian Insurance Coverage & Annuity Firm, Inc .

Table of Contents

Latest Posts

Understanding Financial Strategies Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why What Is A

Understanding Financial Strategies A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Features of What Is Variable Annuity Vs Fixed Annuity Why Deferred Annuity Vs Variabl

Understanding Fixed Income Annuity Vs Variable Growth Annuity Key Insights on Fixed Income Annuity Vs Variable Growth Annuity Defining Choosing Between Fixed Annuity And Variable Annuity Pros and Cons

More

Latest Posts